tax relief malaysia 2018

Income tax relief Malaysia 2018 vs 2017. For your information the IRBM has replaced the above PR No42018 dated 13 September 2018 with the new PR No52021 dated 30 September 2021.

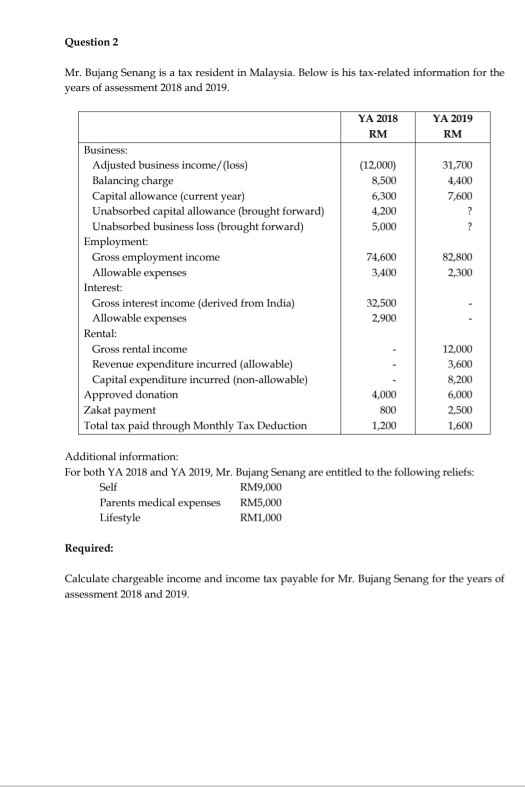

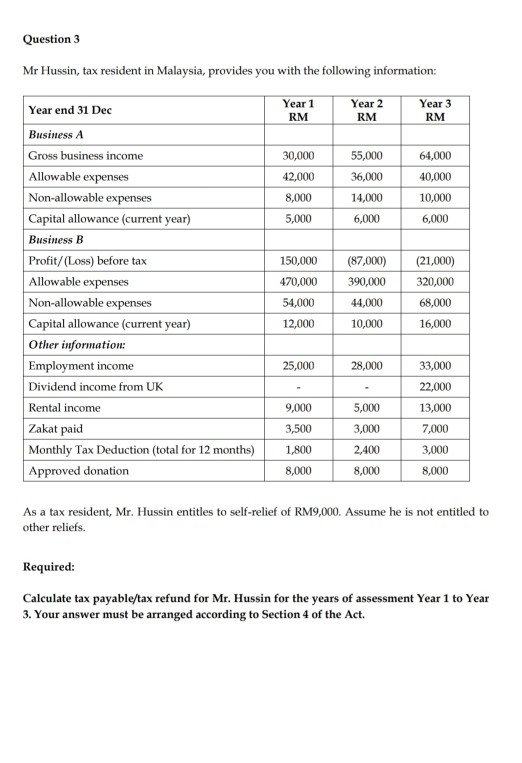

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Immediate actions to pay less income tax next year.

. For Malaysian Resident Individuals. The tax year in Malaysia runs from 1st January to 31st December. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2.

Claim the right amount of Malaysian income tax relief. Relief of up to RM10000 a year for three consecutive years from the first year the interest is paid. Pegangan Dan Remitan Wang Oleh Pemeroleh.

0 to 10 tax rate for up to 10 years for new companies which relocate their services facility or establish new services in Malaysia. Cancellation Of Disposal Sales Transaction. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

However with the self dependent tax relief. As long as your total deposit in the year 2018 is larger than your total withdrawal youre eligible for a tax relief of your net balance up to RM6000. The PS incentive involves a tax exemption for 70 of statutory income 100 for certain activities for a period of five years which can be extended to a tax holiday of up to 10 years.

A 40 late payment penalty of tax due will be imposed instead of the previous 50. If planned properly you can save a significant amount of taxes. 2020 Tax Reliefs.

10 tax rate for up to 10 years for. Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. I understand that if I pay less Income Tax andor Capital Gains Tax than the amount of Gift Aid claimed on.

43 rows For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes. Assessment Of Real Property Gain Tax. Imposition Of Penalties And Increases Of Tax.

A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property. Interest expended to finance purchase of residential property. Summary What are the tax reliefs available for Malaysian Resident Individuals in 2020.

Applications for the exemption would have to be submitted to Talent. Subject to the following. In addition under the new tax regime the maximum penalty would be reached within 90 days instead of.

In our example a taxpayer would have been taxed about 10 of his total chargeable income of RM84300 if he had claimed no tax reliefs at all. Up to RM 12000 for couples seeking fertility treatments. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

Doing Business In The United States Federal Tax Issues Pwc

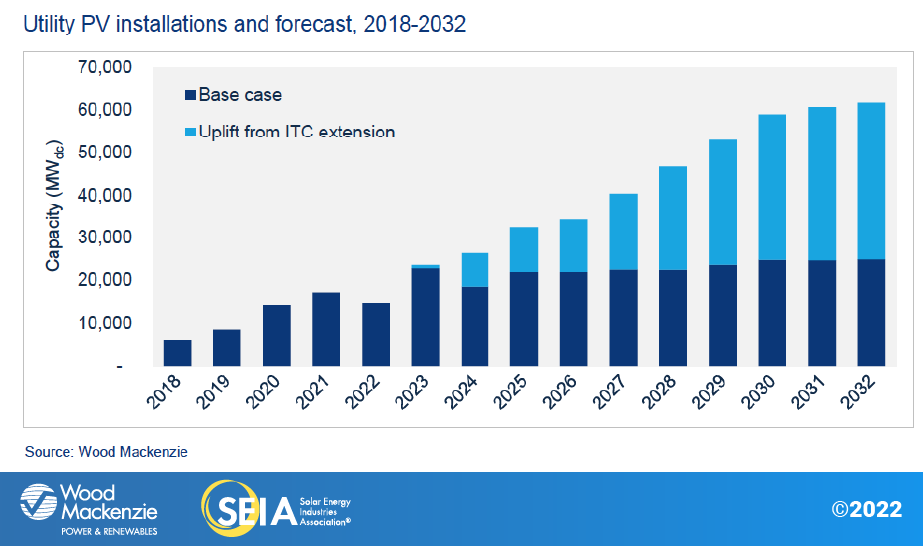

Solar Market Insight Report 2021 Year In Review Seia

Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

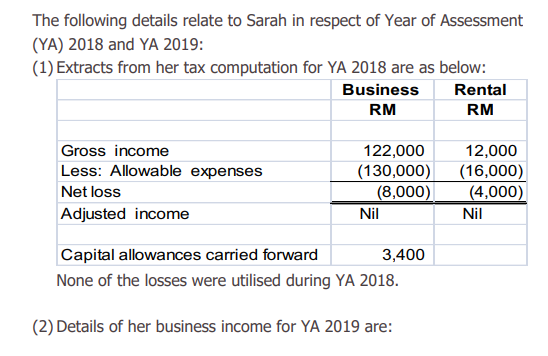

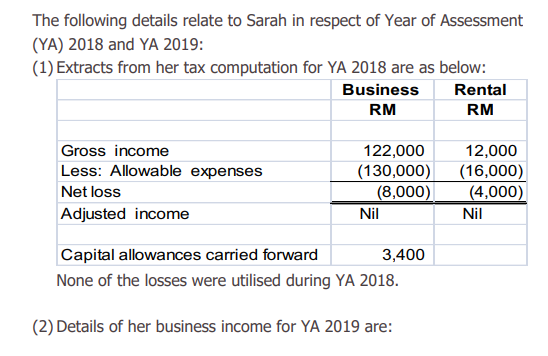

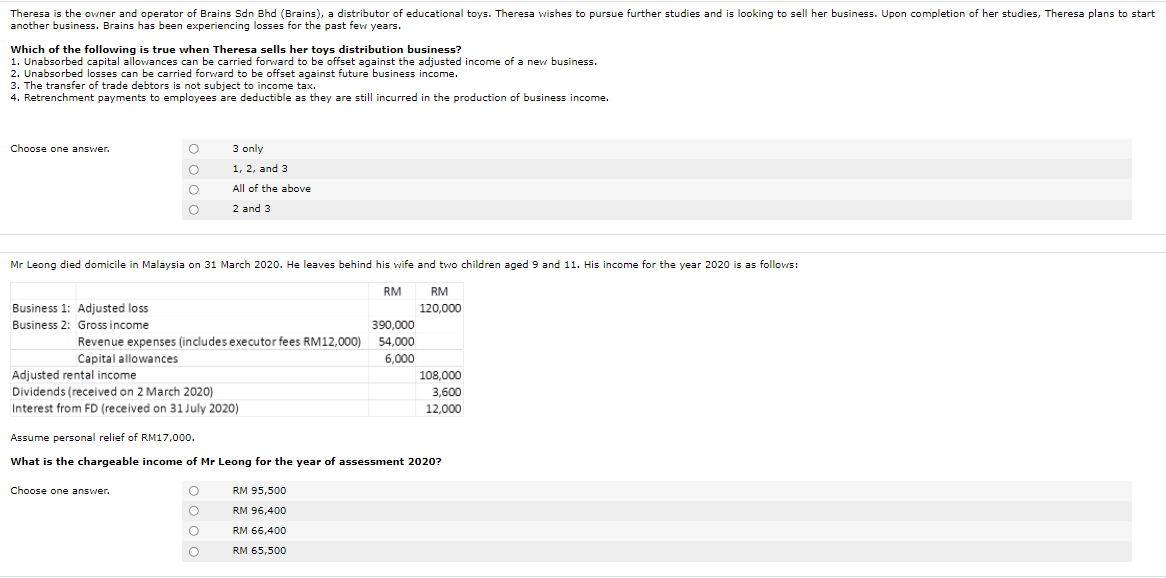

7 Norman And Sarah Who Are Married Are Both Chegg Com

Corporate Tax Rates Around The World Tax Foundation

Newsletter 32 2018 Donation To Tabung Harapan Malaysia Donations Tax Exempted Page 001 Jpg

Country Reports On Terrorism 2018 United States Department Of State

Individual Tax Relief For Ya 2018 Kk Ho Co

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

Tax Incentives In Cambodia In Imf Working Papers Volume 2018 Issue 071 2018

Corporate Tax Rates Around The World Tax Foundation

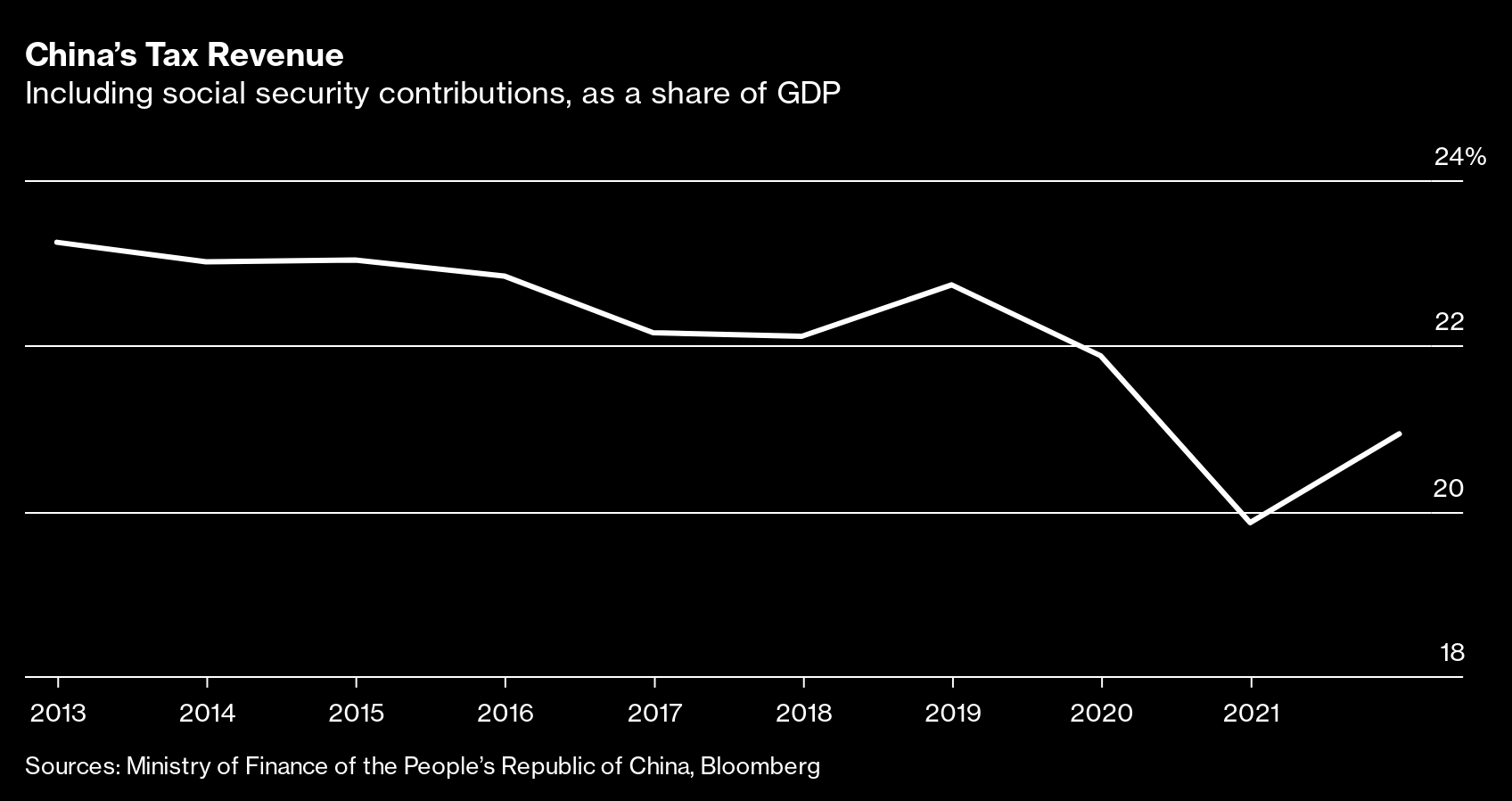

China Embraces Supply Side Economics With Tax Cuts Bloomberg

Governor Cuomo Announces Plans For 2b In Tax Relief For New York Asian Americans For Equality

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Comments

Post a Comment